This article describes search funds and their application in New Zealand. It suggests a way forward for New Zealand searchers, the investment community and business owners looking to exit.

A search fund receives capital from investors for the entrepreneur (“searcher”) to search and acquire a SME business. The searcher aims to improve the business over a period of 3-7 years and sell the business at a much higher value. Stanford’s 2016 research (Stanford GSB, 2016) on fund performance shows investors received a 36.7% internal rate of return (IRR) and 8.4x multiple of investment.

There were 258 search funds by the end of 2015 in the US, 12 in the UK, 11 in Mexico, 9 in Europe and 13 in the rest of the world (IESE, June 2016). I have been told of three searchers in Australia but know of no searchers (yet) in New Zealand.

In 1984, H. Irving Grousbeck pioneered a new investment vehicle, commonly termed a “Search Fund,” with the aim of allowing young aspiring entrepreneurs the opportunity to search for, acquire, manage, and grow a company. —Stanford GSB, 2016

An Alternative Asset Investment

A search fund is an alternative asset investment that sits between venture capital and private equity, and shares the same risk and return profile. It invests in mature SME businesses that are not sufficiently large to attract private equity investment—in New Zealand’s case below $2 million of EBITDA.

In many ways it is similar to private equity funds in that investments tend to be in mature companies, with the aim of increasing earnings and the underlying valuation multiple, then selling after 5 years, with the searcher receiving a return based on performance.

The difference is the investment is smaller, the fund only invests in one company, investors do not have capital commitments but rather an opportunity to invest, and the key member of the fund—the searcher—is the CEO, not just a director.

The Searcher

The searcher is expected to have graduated from an Ivy League Business School and have other evidence of high achievement e.g. Olympic athlete or Rhodes Scholar. The searcher probably has also worked for a few years in an investment bank, management consulting firm or a well-known company. This high bar of achievement is due to a search fund being as much an investment in a person as it is in a particular deal. Overseas, searchers sometimes have little practical experience and come straight out of an Ivy League MBA school. It seems like this lack of experience is less likely to be acceptable to NZ investors, time will tell.

NZ private equity tends to be opportunistic rather than have a particular investment thesis (apologies to Pioneer and Oriens), mainly because the size of the NZ market makes specialisation difficult. It is expected this opportunistic approach will always be used, perhaps in parallel with an investment thesis.

There is one exception to this “young talented MBA” rule. That is is the talented middle-aged general manager in a corporate who is an expert in his or her industry and has a compelling investment thesis about their industry. This has been a growing group of searchers overseas and is probably attractive to NZ investors.

Search Fund Stages

Search Capital?

A searcher may self-fund their search for a company or raise “search capital” to fund their search.

Search capital pays a modest salary, travel, legal fees, certain due diligence fees on deals etc. It also gives these early investors the right to convert their search capital on a stepped-up basis in the target company investment. Note it is expected that 10-15 investment units be sold under “Stanford Terms” (section below), suggesting 10-15 investors, given no investor would have a majority. If $400,000 is raised then each investment unit would be $40,000.

Feedback is being sought from the New Zealand investment community as to their appetite for “search capital”. It is suggested that searchers will probably need to be self-funded but seek future “acquisition capital” expressions of interest i.e. conditional commitments from investors at the start of their search.

If search capital is being raised then capital raising is the first stage and may take 2-4 months, otherwise, “Search” is the first stage.

Stage I: Search

A searcher then spends 1-2 years searching for an acquisition. Search funders generally target industries that are not subject to rapid technological change, are fairly easy for them to understand and are in fragmented geographical or product markets. Within the preferred industries, companies are targeted based on their sustainable market position, their history of positive, stable cash flows, and opportunities for improvement and growth. Search funders and their investors tend to prefer healthy, profitable companies over turn-around situations (Stanford GSB, 2016).

I will be offering advice as to how to conduct their search, though ideally, the searcher will also have a board of advisors.

Stage II: Acquire

On finding a target the searcher negotiates a sale price, performs due diligence, secures capital commitments and finalises carried interest terms with investors. This may take 2-6 months.

Again a board of advisors will prove very useful to assist the searcher with each stage. The searcher may need to seek accounting advice during due diligence and of course legal advice for the sale and purchase agreement (SPA) and the investor agreement.

I will be conducting presentations to wholesale investors about search funds to prepare the ground for the searchers themselves (investors will need to have an exemption under the Financial Markets Conduct Act 2013).

An international search fund investor has already expressed interest in providing investment to New Zealand searchers under “Stanford Terms” (see section below). This probably sets the general terms for the NZ industry.

Stage III: Value Creation

Upon completing the acquisition the searcher establishes a board of directors and spends a year becoming comfortable with the business before creating value through revenue growth, operating efficiency, add-on acquisitions and other private equity type strategies. This may take 3-6 years.

See the example below for an illustration.

Stage IV: Exit

The business is sold, realising the gains made by improving the business. This may take 4-6 months. Carried interest, also known as “manager’s equity”, is vested at the time of the investment and every year for the first 4-5 years leading to the searcher owning about 10% of common equity. On exit, the searcher is paid a further 5-10% based off investment performance.

The search fund acquisition is structured as non-redeemable preference shares with a coupon of about 8% that accumulates as unpaid dividends. This means that the investors receive a return of their initial capital with a modest dividend before the searcher begins to participate in equity appreciation. Thus investors receive protection in downside scenarios, similar to the hurdle rate in private equity investment.

Performance

Stanford’s 2016 research on fund performance shows investors received a 36.7% internal rate of return (IRR) and an 8.4x multiple of investment. However, fund performance drops to 28.8% IRR and 3.1x if three very successful outliers are removed. Exactly which data to use depends on the objective.

Including the outliers is appropriate when comparing alternative investments such as venture capital and private equity funds as these funds also see performance being skewed by outliers.

Excluding outliers is probably best for investors and searchers as it provides a more likely estimate of search fund performance.

Investors

Search Funds investors need to be professional investors. Firstly, because they understand the average results described above contain a wide range of funds including those that failed—just like PE and VC investments, some investments will be unsuccessful.

Secondly, because it is not wanted to inadvertently breach the Financial Markets Conduct Act 2013 by not providing a product disclosure statement to retail investors. It is thought that it is best to claim exemptions by only seeking funds from wholesale investors who do not require disclosure under the Act.

Carried Interest (or “Manager’s Equity”)

A typical search fund will vest 20% (30% if two searchers) of the common equity in the acquired company to the searcher. There might be three tranches:

1) upon acquisition

2) over time, perhaps every year for five years

3) on achieving performance benchmarks on exit

Performance benchmarks may start at 20% IRR and max out at 30-40% IRR (or cash on cash return) on a sliding scale.

Note that common equity is paid out after the preference shares held by investors (described below) on exit. If the fund has performed poorly then there may be common equity payout—similar to a poor performing private equity fund not receiving carried interest.

Stanford Terms

Every other year, Stanford publishes a Search Fund Study with observations that include what the market sees as standard terms for investors and searchers. I have confirmed these terms with an international search fund investor. Here are the key Stanford terms:

No Majority Investors

The search fund model seeks a balanced investor base with no large-stake investor who may manipulate/steer the searcher into industries or geographies that such investor prefers.

Principal (Searcher) Carried Interest

Principals earn common equity in the acquired company in return for identifying and acquiring the target company, and for achieving specific operating results. The Principal expects to have the opportunity to earn between 25% (one searcher) and 30% (two searchers) share of the common equity, depending on the ultimate size and structure of the acquisition. The earned equity is comprised of three parts:

- Deal Creation: Upon completion of the acquisition, the Principal will receive 1/3 of the outstanding equity

- Time-Based Participation: The Principal will receive 1/3 equity payment annually spread across 4 years following the acquisition

- Performance-Based Participation: The Board of Directors creates an aggressive set of operational and financial milestones that give the Principal the opportunity to earn the last 1/3 carried interest in the form of restricted equity, where the restrictions are lifted as investor IRR hurdles are met (if IRR<20.0%, no performance-based interest is earned; between 20.0-35.0% IRR, interest is earned linearly, and at or above 35.0% IRR the performance-based carried interest is fully earned).

Timeline

A search fund timeline as described in the stages section would also be part of the terms as would the general target parameters outlined in “Stage 1: Search” above.

Where there is search capital raised:

Search capital raised

US$400K-$600K, I suggest NZD400K given lower NZ expenses.

Step up

When a search fund makes an acquisition, original investors receive a percentage step up on all initial search capital as compensation for taking on early-stage risk, regardless of whether or not they participate in the acquisition round. The standard step up is 1.5x.

Right of First Refusal

Original investors of search capital have the right to participate in the financing of an acquisition but are not obligated to do so.

Illustrative Example

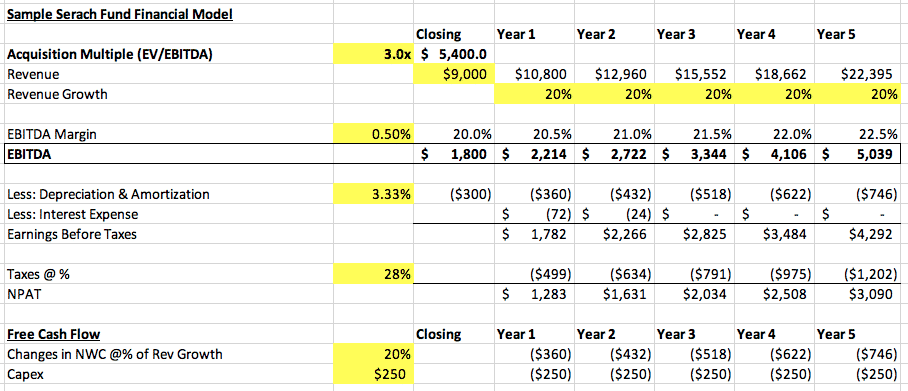

To illustrate the financial return and carried interest of search funds, I’ve created an illustrative search fund financial model (roughly based off a Stanford example). Yellow highlighted cells are inputs.

Firstly, the P&L. The example business is acquired for Enterprise Value (EV) of $5.4M, a 3x EBITDA multiple. The searcher increases revenue by 20% every year, EBITDA margin by 0.5% every year. Free cash flow is reduced by net working capital and capex.

Figure: Example P&L (‘000)

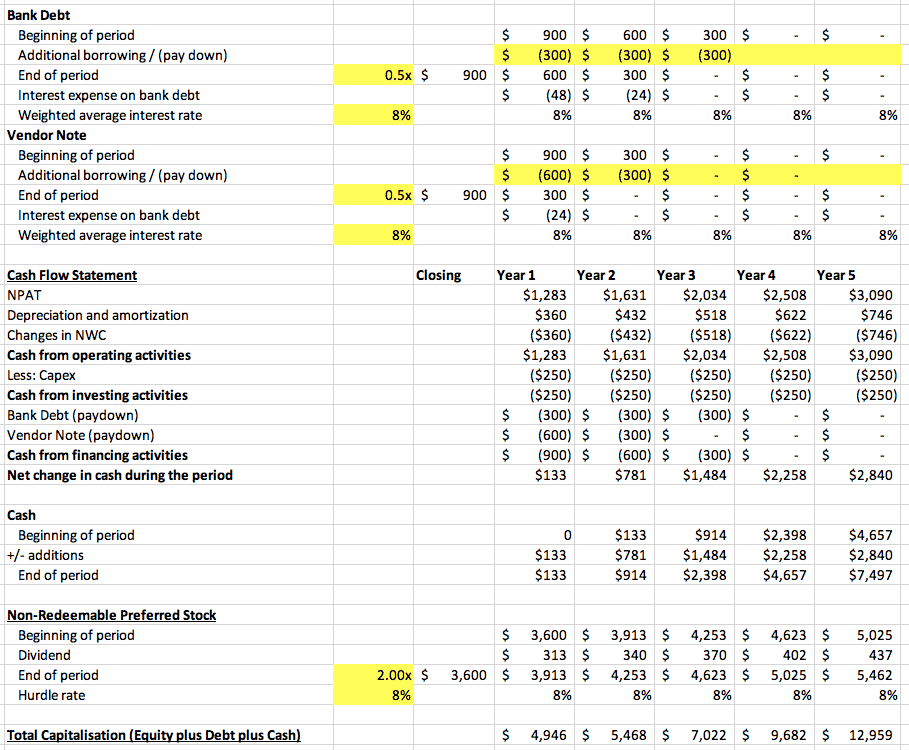

Next the capital structure and cash flow. The acquisition is financed by:

- 0.5x (EBITDA) bank debt at 8% interest with $300K-$900K paydown per year for three years

- 0.5x vendor note at 8% interest paid down as soon as bank debt obligations allow

- 2.0x Non-Redeemable Preferred Stock (or in NZ “Non-Redeemable Preference Shares”) with an 8% hurdle rate Payment In Kind (PIK) dividend.

Figure: Cash flow and Capital Structure (‘000)

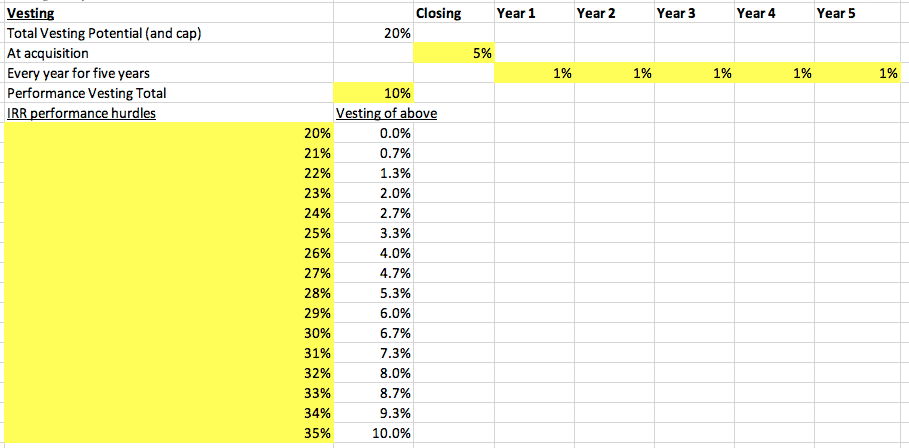

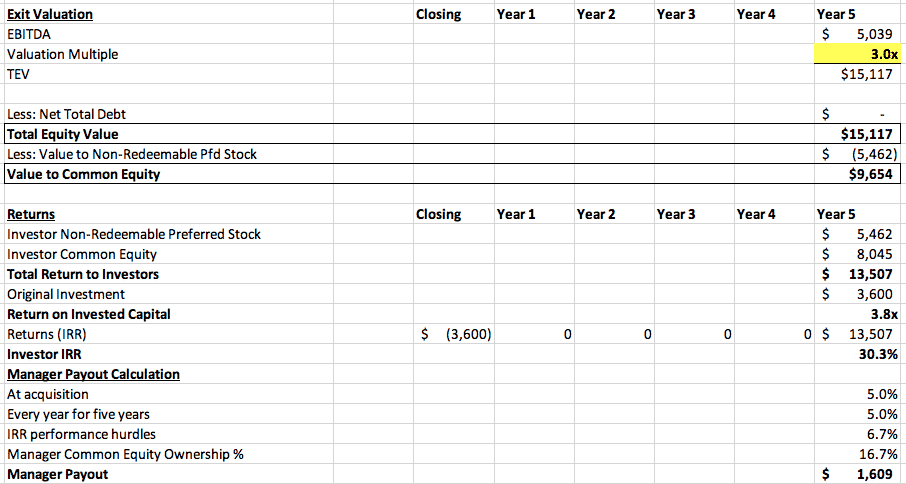

Then the vesting. In this example, the search fund entrepreneur(s) will vest into 20% of the common equity (“Manager Equity”) of the acquired company in three equal tranches:

- Tranche 1: 5% Upon acquisition of a company

- Tranche 2: 1% every year over 5 years, as long as searcher remains an employee of the acquired company

- Tranche 3: Up to 10% straight line vesting, by achieving performance benchmarks (e.g., IRR hurdles).

Figure: Manager Equity Vesting

Lastly the returns. In this example, the company was sold at a 3x multiple on a higher EBITDA with all debt paid down. The Value of the Common Equity after Non-Redeemable Preferred Stock was then distributed between the investors. The investment achieved a 30.3% IRR (3.8x) so the manager was vested 6.7% for meeting that particular performance hurdle. Total Manager return is $1.609M.

Figure: Investor and Manager Returns (‘000)

Summary

In this example, the target company is purchased for $5.4M, at a 3x EBITDA multiple ($1.8M), financed by mainly preference shares with an 8% PIK dividend, and some debt.

Debt is prudently paid off over the early years. Preferences share value increases as dividends are accrued as PIK not paid out—the hurdle rate in practice.

In year 5 the business is sold for $15M (TEV), at the higher EBITDA of $5M, at the same EBITDA 3x multiple. Preferred Stock is first subtracted to arrive at common equity of $9.6M. The searcher/manager’s vested amount of common equity is calculated to be (5%+5%+6.7%=) 16.7% or $1.6M. Leaving investor common equity of $8M.

In this example, the investment of $3.6M has returned $13.5M in 5 years, IRR is 30.3% and cash on cash (“Return on Invested Capital”) is 3.8x. The searcher has made $1.6M for his or her time and effort plus a modest market-based salary throughout.

Growing NZ’s Capital Markets

New Zealand has a particular problem when it comes to capital markets with the NZX punching below its weight. The NZX market cap is only 47% of NZ GDP compared to Australia (114%) and Singapore (243%). In my opinion, the undeveloped nature of our public markets means that we need to look to the private markets including alternative investments to boost investment and grow the NZ economy.

Also, like the Irish, New Zealand has a large overseas expat community many of whom would like to return to NZ but cannot face the much lower NZ salaries than what they get in New York, LA, Hong Kong or London. An active search fund community in New Zealand will also help attract young aspiring entrepreneurs back to NZ, attracted by a path that may lead to considerable wealth while enjoying the lifestyle and being back with family.

A Way Forward for NZ Search Funds

In order to create an active search fund community in New Zealand we need three things:

- Search fund investors

- Searchers

- Business Owners

Search Fund Investors

Investors are looking to diversify risk while sustaining returns. Traditional asset types may not offer sufficient diversity during an economic crisis, as seen during the GFC. Diversifying a portion of a fund into alternative assets is one strategy that many NZ firms have used—and search funds fit with that strategy.

I acknowledge that many firms see alternative assets are inefficient and a barrier to keeping fees low. Whereas, others have decided the risk diversification and high returns make the active management costs worthwhile.

It seems more likely that family offices, endowments, high net worth individuals and institutions with funds actively managed are more likely to invest.

Investments are likely to be restricted to “wholesale” investors as per FMCA.

Searchers

Talented kiwis looking to return are aware of what is happening in NZ if only because their family and friends keep them updated. It is assumed that presenting to investors will lead to word of mouth reaching potential searchers offshore. It may also be possible to use KEA and other expat type networks.

Business Owners

Business owners want to exit at the highest price possible but they also want the business owner to receive the same satisfaction in building the company that they did. The business sales price to the searcher will be at market rates plus the upside in seeing a talented returning young kiwi taking the business on the next step in its journey. The business owners may choose to leave money in the business.

Next Steps

The first step is to educate the wider investment community on the benefits of search fund investment. I will make those presentations over the next 12 months.

Concurrently, potential searchers should contact me for advice on how to start the process and business owners on potential searcher interest.

In 2017, for the first time mid-market investment activity by private equity has exceeded $300M at $313M and venture capital investment increased to a record $217M (NZ PE and VC Monitor 2018). Wouldn’t it be great if in 2027 $200M was being deployed to help retired owners exit their business to returning overseas young New Zealanders…

Notes

Sources:

“Search Fund Primer 2016”, Stanford Graduate School of Business, accessed 29/9/17.

“International Search Funds – 2016 Selected Observations”, IESE, June 2016 in IESE Search Funds

Legal Disclaimer: Information on this site should not be a substitute for legal advice. All the information published on this website, or in any article herein is true and accurate to the best of the authors’ knowledge. No liability is assumed by Bruce McGechan for losses suffered by any person or organisation relying directly or indirectly on information published on this site.